How Digital Tools Support Pakistani Tax Professionals: Income Tax Return Filing Made Easier

I’ve worked with Pakistani businesses for over twenty years. Every tax season, business owners walk into tax consultants’ offices with bags of receipts, handwritten notebooks, and Excel files that don’t add up. The consultant spends hours organizing the mess before preparing the actual return.

This wastes everyone’s time and money; the tax consultant bills for data entry rather than providing tax advice. The business owner pays more. Everyone rushes to meet FBR deadlines.

The businesses that make their tax consultant’s life easier get better service, pay lower fees, and have smoother FBR dealings. The secret? Digital tools that organize financial data throughout the year.

Modern accounting software designed for Pakistani businesses makes this partnership between you and your tax consultant much more effective.

The Pre-Filing Chaos

Tax season in Pakistan runs September to December. Tax consultants in Karachi, Lahore, Islamabad, and Rawalpindi work around the clock filing FBR returns.

The typical process:

Week 1: Client brings mixed records – bank statements, handwritten registers, receipts, Excel files. Hours spent understanding the data.

Week 2-3: Endless back-and-forth. “Where’s this invoice?” “What was this expense?” The consultant’s team enters everything, finds discrepancies, sends more questions.

Week 4: Rush to file before deadline. Details get missed.

This costs businesses three ways:

- Higher fees: Tax consultants charge for data cleanup hours at professional rates

- Missed savings: No time for strategic tax planning

- Audit risk: Rushed filings have more errors

What Tax Consultants Actually Need From You

I’ve asked dozens of income tax consultants what makes their job easier. The answer is consistent:

Organized, accurate financial data that’s easy to verify.

Specifically, they need:

- Complete transaction records: Every sale, purchase, expense clearly documented

- Bank reconciliation: Your records match your bank statements

- Categorized expenses: Not just “expenses” but broken down by type (rent, utilities, salaries, etc.)

- Supporting documentation: Invoices, receipts, payment proofs readily available

- GST/Sales tax records: Properly tracked for businesses registered with FBR

- Project-wise data: If you run multiple business activities, separate accounting for each

When you walk in with this level of organization, your tax consultant can focus on what they do best: tax planning, compliance strategy, and representing you professionally before the FBR.

How Accounting Software Changes the Game

Before Digital: A Lahore trading business spent 3-4 days monthly compiling reports. Tax season required two weeks of organization. Professional fees: Rs. 80,000. Limited time for strategic planning.

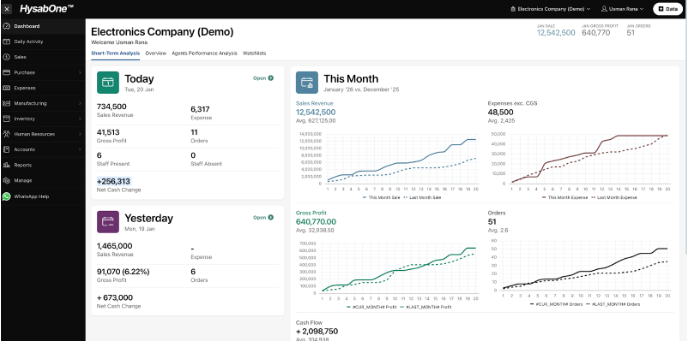

After Digital: Same business using HysabOne. Daily transactions entered once. System automatically categorizes, reconciles, generates FBR-compliant reports, stores invoices digitally.

Tax season transformation:

- Week 1: Export organized reports. Tax consultant receives clean data.

- Week 2: Consultant reviews (no cleanup needed), identifies Rs. 200,000 in missed deductions.

- Week 3: Strategic tax planning, well-documented filing.

Result: Fees dropped to Rs. 45,000. Tax savings increased Rs. 200,000. Better compliance.

The Partnership Between Software and Tax Professionals

Here’s what most business owners miss: good accounting software and good tax consultants work together perfectly.

The software handles:

- Daily transaction recording

- Automatic calculations

- Report generation

- Document storage

- GST/Sales tax tracking

The tax consultant handles:

- Tax law interpretation

- Strategic planning

- FBR representation

- Compliance advice

- Audit support

When you have both, you get the best outcome. Your software ensures your data is organized and accurate. Your tax consultant uses that clean data to minimize your tax liability legally and ensure full FBR compliance.

What to Look for in Business Accounting Software

If you’re considering digital tools to support your tax filing, here’s what matters:

✓ FBR/GST Compliance: Generate reports in formats tax consultants recognize and FBR accepts

✓ Export Capability: Your tax consultant should be able to easily extract the data they need

✓ Audit Trail: Every transaction tracked with date, time, user – valuable during FBR audits

✓ Document Attachment: Link invoices and receipts to transactions digitally

✓ Multi-year Data: Access previous years for comparison and trend analysis

✓ Local Support: When you have questions, get answers from someone who understands Pakistani tax requirements

HysabOne offers all these features designed for Pakistani businesses with FBR compliance built in, starting at Rs. 3,000 per month.

Real Cost Comparison

Let’s look at actual numbers:

Manual System Annual Costs:

- Monthly bookkeeping: Rs. 30,000 x 12 = Rs. 360,000

- Tax filing professional fees: Rs. 80,000

- Missed deductions (conservative): Rs. 100,000 Total Annual Impact: Rs. 540,000

Digital System Annual Costs:

- Software: Rs. 3,000 x 12 = Rs. 36,000

- Reduced bookkeeping: Rs. 15,000 x 12 = Rs. 180,000

- Tax filing fees (reduced): Rs. 45,000

- Tax savings from better planning: Rs. 200,000 saved Total Annual Impact: Rs. 61,000 cost / Rs. 200,000 saved

Net Benefit: Rs. 479,000 per year

See detailed pricing plans to find the right package for your business size and needs.

Getting Started

Start organizing digitally right after filing this year’s return. Beginning at a fiscal year start makes transition cleanest.

Month 1: Implement software, enter opening balances Months 2-11: Record daily transactions (10-15 minutes daily) Month 12: Export organized reports for consultant

Next tax season, walk in with everything properly organized. Lower fees, better tax planning.

Final Thoughts

Your tax consultant is a valuable professional. Don’t waste their time (and your money) having them organize basic financial data. That’s not their expertise, and it’s not why you hired them.

Use accounting software to handle data organization. Let your tax consultant focus on tax strategy, compliance, and representing you before the FBR. That’s the partnership that saves you money and keeps you compliant.

The businesses I’ve seen thrive are the ones where the owner, the accounting system, and the tax consultant all work together seamlessly. The software keeps daily records accurate and organized. The tax consultant uses that foundation to minimize taxes and maximize compliance.

Tax season doesn’t have to be chaos. With the right tools supporting your tax professional, it can be smooth, strategic, and significantly less expensive.

Ready to make your tax consultant’s job easier (and reduce your fees)? Start organizing your financial data digitally today. Your tax consultant will thank you, and your bank account will too.

About the Author

Mirza Saqib has over 20 years of experience helping Pakistani businesses implement practical technology solutions that improve tax compliance and reduce professional service costs. He works closely with tax consultants across Islamabad and Rawalpindi to help their clients adopt better financial management practices.